Products & Solutions

The power of science.

Our products harness the power of science. Our solutions put that power into the hands of our clients. The result? Profitable and sustainable growth for their business.

OVERVIEW

Our suite of forward looking science-based analytics and software products are meant to drive profitable and sustainable growth for our clients. CoMeta and ChemMeta do just that. Our products harness the power of science at machine scale, delivering actionable insights and opportunities that position you to capitalize on risks you may have once avoided.

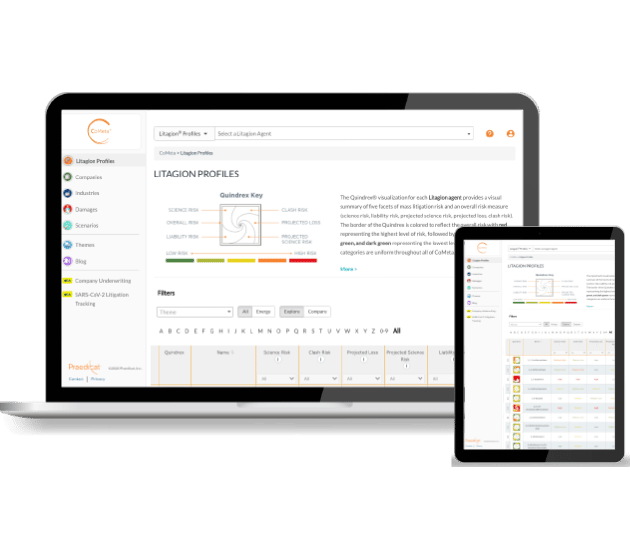

CoMeta®

CoMeta brings our Emerging Risk Framework methodology to life and into the hands of our clients, making emerging risks actionable. With CoMeta, the timeline of risk emergence is delivered to our client’s dashboard, enabling casualty insurers and reinsurers to make smarter business decisions informed by science and industry-leading technology.

Offering unique and valuable company exposure information for underwriting, along with the tools needed for emerging risk identification and prioritization, CoMeta enables the creation of informed underwriting strategies, and the ability to execute on those strategies with confidence.

CoMeta includes a dynamic database of algorithmically identified emerging risks, which we call Litagion® agents, together with qualitative and quantitative exposure‐based information to assess liability risks for agents, companies and industries. We distill all of this data and more, connecting the risks to over 100,000 companies, into one actionable company risk score making it easier than ever to underwrite with forward-looking data.

We also offer the Praedicat CoMeta API that seamlessly integrates robust liability risk analytics into enterprise-wide systems, web applications and commercial software. Click here to learn more about the Praedicat CoMeta API.

ChemMeta®

We call ChemMeta the next big thing in product stewardship. Why? Because ChemMeta can help you identify, track, and manage emerging risks in an unbiased and systematic way at machine scale. And that means you can spot the new science and predict what’s next.

With that kind of scientific data at your fingertips, you can design better and safer products, bring them to market faster, all while anticipating potential regulatory risk and issues.

Being armed with that kind of actionable foresight is indeed, a big thing. Being empowered to lead the marketplace with innovative product stewardship and risk management approaches puts you in the driver’s seat for profitable and sustainable growth.

Sound appealing? Learn more about how ChemMeta can help your business.

BROKER SOLUTIONS

Liability insurers struggle with risks they cannot accurately quantify and that could present major payouts (they remember asbestos!). Too often, the solution is to rely on exclusions. By using innovative technology, cutting edge analytics and smart data modelling, Praedicat is providing insurers with the information they need to design new insurance products that offer coverage for the hardest latent risks.

Hundreds (100 | 100 | 100)

Hundreds is the first casualty product designed in the innovation accelerator program at Lloyd’s Lab. Praedicat is working with brokers and insurer clients who will offer Hundreds coverage, tailored to the needs of insureds, providing them with genuine protection from potential mass tort events. It also enables insurers to understand and quantify the risk so they can prudently grow their casualty book.

Hundreds closes a major protection gap in casualty. Recent mass torts (e.g. glyphosate and talc) have risk managers looking for innovative solutions to protect their business. Existing coverage is not well designed to handle latent catastrophic events with cross-LOB clash. Hundreds is coverage designed to fill that gap, bringing all losses relevant to the event under a single cover, with an extended reporting period to cover those unforeseen events on the horizon.

With Hundreds, insurers can:

- Offer coverage to protect against latent catastrophic (mass tort) events, moving from an environment of risk exclusion to one of protection.

- Bundle the two lines of business most exposed to latent casualty catastrophes, GL and D&O, to implement a well-designed solution that addresses cross-LOB clash directly and effectively.

- Use Praedicat software for analytics-driven underwriting armed with knowledge about exactly which Litagion® agents your clients are exposed to – including newly emerging casualty cats, such as glyphosate and talc – and tailor coverage against potentially catastrophic events.

- Manage aggregation risk transparently and guide your reinsurance purchase accordingly.

New (Re)insurance Product Development

Plastics. Mobile phones. 3D printing. Nanotechnology. Claims data tell us everything we need to know to cover these risks, right?

Maybe not. The downstream impacts of these must-have, ubiquitous technologies aren’t known for years, which is a scary proposition for insurers. The temptation is to limit coverage or rely on exclusions. But there’s a lot of business here and limiting exposure effectively leaves a field of opportunity to lie fallow.

That doesn’t have to be the case. Our New (Re)insurance Product Development Program alters your perspective from historical data to future-focused intelligence, quantitatively expressed, making that once fallow field ripe with growth and opportunity.

This program allows you to:

- Take advantage of an underinsured market, confidently assessing risk exposure while writing new business.

- Design innovative new products that provide informed coverage on a named peril basis to that underinsured market.

- Build aggregation risk management into new products to create sustainable growth.

(RE)INSURANCE SOLUTIONS

Our Risk Transfer solution transforms emerging risk from a driver of risk avoidance to an agent of growth and opportunity, meeting your specific needs while facilitating the growth of your business.

Climate Casualty Risk

As climate advocates turn to the courts to seek accountability and redress, new climate-related risks for casualty insurers are emerging. That means insurers urgently need to assess their climate casualty exposures, which may have potential to become catastrophe-level losses.

Well, we have some sunny news to share.

Our climate casualty risk program, integrated into CoMeta, provides you with robust analytics for climate risks, helping casualty insurers underwrite better and assess their exposures and reserves in the face of a changing climate. This program provides:

- Climate liability scenarios that contemplate a range of climate-induced litigation events that could trigger general liability, D&O, and Workers’ Compensation policies

- Specific company exposures for 128,000 companies for use in underwriting

- Multi-line clash scenario analysis feature makes it easy to monitor and explore cross-line climate liability aggregations and devise strategies for managing exposure going forward

- Litigation tracking to actively monitor all climate-related complaints with commercial defendants filed in U.S. state and federal courts

88%

Horizon Scanning

Our Horizon Scanning Program uses science as its emerging risk group, with a machine learning algorithmic approach that is all about identifying emerging risks so you can be proactive, not reactive.

In fact, according to TechValidate, “88% of surveyed underwriters report that Praedicat helps the most with providing early warning of emerging risks.”

Our Horizon Scanning Program allows you to:

- Produce and curate custom watch lists and comprehensively track emerging risks.

- Generate alignment around a common view of risk – by leveraging the objectivity of scientific results, you can set a solid foundation and common ground for having a dialogue around which risks should be on your list, and which shouldn’t.

- Understand which risks are the riskiest and focus on them, developing informed action thresholds to mitigate unexpected surprises.

Technical Underwriting & Risk Engineering

Our Technical Underwriting & Risk Engineering Program curates and quantifies scientific literature to help you gain an objective understanding of your current clients, clients up for review, and high priority prospects.

Further, our ability to provide risk engineering insights at machine scale – with data on over 128,000 companies – means the insights you receive are about as comprehensive as possible. That means the conversations you have with current and prospective clients when writing commercial liability insurance are more informed, and the opportunities to grow your business are not only better defined, but also more abundant.

Our Technical Underwriting & Risk Engineering Program includes Horizon Scanning, and empowers you to:

- Advance your new business prospecting efforts and improve your risk selection through a better understanding of exposures.

- Effectively underwrite complex risks with unprecedented data on previously unquantified and poorly understood risks.

- Access targeted exposure information by company to execute on underwriting strategies.

- Strengthen your position as an expert and trusted advisor with objective science-based insights that drive meaningful risk conversations with your clients.

- Provide your risk engineers with science information at scale to augment and enhance their efforts.

Your clients and prospects may not know about the skeletons in their own closets. That doesn’t mean you shouldn’t.

128,000

Technical Treaty & Facultative Underwriting

With our Technical Treaty & Facultative Underwriting Program, reinsurance risks become transparent like never before. Go beyond “underwriting the underwriter” and underwrite the underwriter’s portfolio with unprecedented granular risk information.

Here’s how the Technical Treaty & Facultative Underwriting Program, which includes Horizon Scanning, can help your business:

- Gain clarity and develop an informed perspective on the risks you are being exposed to, through deeply textured quantitative information.

- Identify companies and risks in your clients’ portfolios for tailored facultative solutions.

- Better support your clients’ growth goals by aligning your solutions to their exposures, and managing your risks more effectively.

- Execute on underwriting strategies with targeted exposure information by portfolio and by company.

- Reinforce your position as an authority and trusted advisor with unbiased science-based insights that drive substantial risk conversations with your clients.

Bring science to the art of reinsurance underwriting.

Portfolio Steering & Underwriting Strategy

Our Portfolio Steering & Underwriting Strategy Program is focused on identifying areas of opportunity and constructing the roadmap for sustainable profit and growth for your business. The insights from our portfolio analysis can steer portfolios toward higher profitability and greater diversification. And these strategies can ultimately get disseminated via underwriting guidelines to influence individual account risk selection and policy terms including choice of limit, attachment, form, and price.

When we say our Portfolio Steering & Underwriting Strategy Program helps you create a roadmap for growth, it’s because it empowers you to:

- Identify companies and industries where growth opportunities are greatest, and provide you with the tools needed to risk-manage that growth responsibly.

- Use science and portfolio exposure data to develop strategies for sustainable growth and diversification, allowing you to broaden your coverages by tailoring or eliminating exclusions.

- Leverage unbiased science and insights from big data to review, revise and create new underwriting strategies and guidelines.

- Protect your portfolio against adverse risk selection.

- Develop a casualty accumulation management program that both monitors emerging risk aggregations and focuses your reinsurance purchasing.

67%

Capital Management, Ratings & Regulatory

According to S&P, 67% of insurers have an ERM score of adequate. Adequate doesn’t stand out. Wouldn’t you rather stand out?

Collaborating with us will move your approach to latency risk management, the heart of casualty risk, from adequate to elite. Why? Because enterprise risk management excels when potential risks are rigorously delineated, quantified, and connected to commercial entities.

Our Capital Management, Ratings & Regulatory Program offers you a wealth of information that does just that, with features allowing you to:

- Help you preserve capital by increasing your visibility into unknown risks, developing risk tolerances, crafting a reinsurance strategy and determining cat loads.

- Tap into our extensive library of science-based scenarios for your board, rating analysts and regulators.

- Be armed with deep insights about your exposures and strategies to address them as you prepare for your meetings with rating and regulatory analysts.

Rise above the 67% and stand out.

GLOBAL INDUSTRIAL SOLUTIONS

With ChemMeta, you are empowered to make more informed decisions about the chemicals, products, substances, and processes related to your business by leveraging science-based business intelligence, brought to you at machine scale. That means better and safer products, brought to market faster – our take on global industrial solutions with a big nod to product stewardship.

Horizon Scanning for Chemicals

“Vision is the art of seeing what is invisible to others.” Jonathan Swift said that, and if he’d been alive today, he might have been talking about ChemMeta. Let us explain.

If you could read through all of the scientific journals in the world, tracking the toxicology and environmental health of thousands of chemicals in real time, you’d have visibility into an enormous amount of intelligence.

Our Horizon Scanning for Chemicals Program delivers you that vision, enabling you to:

- Use technology to stay on top of the massive amounts of literature relevant to your product stewardship efforts.

- Get ahead of the curve using our data aggregation and modeling methodology, which translates scientific information into actionable business intelligence.

- Be visionary, spotting the new science as it emerges, anticipating what’s next, and making decisions based on the potential future path of science rather than the past.

Dynamic Restricted Substance List

Imagine the capability to expertly manage, rapidly refresh and implement a restricted substance list (or watch list), forecasting the impact of the substances you use in your business, anticipating potential regulatory requirements of your products, all while protecting your brand.

You’ve imagined what Praedicat does today. Our Dynamic Restricted Substance List Program not only gives your people the ability to curate a dynamic RSL, but also allows you to:

- Use unbiased scientific results to build consensus for which chemicals should be on your list, and which shouldn’t.

- Keep on top of innovation – with the massive amounts of new products being developed and the seemingly limitless number of ingredients used to create them, ensure your finger sits squarely on the pulse of science that tracks innovation and understand how something new may affect your business.

- Create a list that doesn’t just add new items but also drops items when the science suggests they are safe. Plus experience growth by using the information to restrict substances to only exposure settings identified as harmful by scientists, allowing you to maximize revenue while minimizing risk.

Product Substitution & Reformulation

True story – one of our clients wanted to reformulate a product facing regulatory withdrawal and challenged us with the task of analyzing four substitute chemicals in a period of two weeks. Normally they would handle this internally, resource ten people for two months or more and wait for the results.

Leveraging our algorithms we performed the analysis in two weeks, providing them with the intelligence they needed to make informed decisions and move forward with their reformulation with confidence.

Our Product Substitution & Reformulation Program not only accelerates ingredient substitution and product reformulation, but increases confidence while doing it.

Furthermore, this program facilitates:

- Keeping up with the science including highlighting new studies on what you care about most, every week, clearly showing how they impact the overall literature.

- Being nimble and fast with decision making, confidently and quickly progressing based on structured data extracted from scientific literature.

- Identifying potential growth opportunities through the implementation of lower risk chemicals.

As our client said, “It is getting more and more competitive, so to choose substitutes faster and get to market sooner is monumental.”

LITIGATION

TRACKER

PLATFORM

With the intensifying social inflation environment in the United States and increasing number of new mass litigations, Praedicat’s litigation tracker is a key tool for sharpening underwriting and claims strategies, quantifying exposure to current litigation, and managing the risk of litigation that has yet to materialize.

Tracking Mass Litigation in the US

Initially launched in CoMeta® to help casualty carriers navigate the flood of complaints filed against companies alleging negligence in exposing workers and consumers to COVID-19, the litigation tracker now also offers important litigation information around additional mass litigations:

- PFAS (per- and polyfluoroalkyl substances),

- Toxic baby food (heavy metals in baby food)

- Paraquat (an herbicide alleged to cause Parkinson’s disease).

- Cellphones

- Chlorpyrifos (Pesticide)

- Carbon Dioxide

- Methane Emissions

The litigation tracker platform, which monitors U.S. courts for casualty-relevant litigation complaint by complaint, enables (re)insurers to stay abreast of and respond to these fast-moving litigation events.

Moving forward, we expect to continue to expand our mass litigation court data, prioritizing the addition of newly launched or accelerating litigation events as the tool becomes even more robust.

PRAEDICAT

COMETA

API

The Praedicat CoMeta API is an application programming interface that seamlessly delivers Praedicat’s powerful liability risk analytics in an on demand, scaled, and customized way. The Praedicat CoMeta API provides all the data elements captured in the CoMeta database and can be directly integrated into enterprise-wide systems, web applications and commercial software.

What are the benefits?

The Praedicat CoMeta API allows you to gain insight into risk across a broad cross section of the 128k companies that Praedicat profiles. And the data continuously refreshes, so the content is evergreen and ever-relevant. The Praedicat CoMeta API also allows you to customize what information underwriters are able to see while integrating effortlessly into their processes.

The Praedicat CoMeta API makes connecting to, and deriving maximum benefit from, Praedicat’s unique latent liability risk analytics fast, simple, and secure.

Integration

How do you integrate the API into your business?

You can obtain the full list of companies in Praedicat’s database and predetermine the companies for which the underwriters can view Praedicat’s data and risk metrics.

You can also create rule-based systems for underwriters. Here are some examples of how the API delivers value to our clients:

- If DEHP is a top driver of loss in your portfolio, flag each company linked to DEHP for review by the underwriter

- Expose only the top portfolio risks, defined along a number of different dimensions, to underwriters

- Easily incorporate Praedicat’s loss estimates into your pricing model

- Create your own logic to provide underwriters with a red/yellow/green company risk score

Praedicat CoMeta API Features

Flexible – Our APIs provide you access to virtually any data element in CoMeta allowing you the flexibility to consume CoMeta’s data and analytics in the manner that best suits your business objectives.

Evergreen – Our APIs are updated with every CoMeta release so that your systems can take advantage of the most up-to-date information available. New datasets are automatically added to our APIs providing you with instant access to any new data we publish that you subscribe to.

Platform agnostic – We offer a set of RESTful APIs with response in JSON format that can be consumed by any platform. If you are acquainted with using APIs, you will be up and running in no time.